After ExxonMobil’s swathe of world-class discoveries in Guyana’s offshore Stabroek Block, the Guyana-Suriname Basin emerged as the world’s hottest drilling location. While Guyana’s economy is booming, becoming an oil superpower, neighboring Suriname has yet to benefit from the basin’s immense hydrocarbon potential, despite world-class oil discoveries in offshore Block 58. Suriname, a small country with a population of less than 700,000, which is among South America’s poorest, is believed to possess petroleum potential comparable to that of its neighbor. While the government in the capita,l Paramaribo, is hungrily eyeing Guyana’s success as the world’s newest petro-state, there are signs Suriname’s long-awaited oil boom will finally take off.

President Chan Santokhi’s administration pinned its hopes on an oil boom, similar to Guyana’s, beginning in 2025 with the development of Block 58, aiming to rescue Suriname from a deep economic crisis. This, Paramaribo hoped, would deliver wealth and urgently needed revenue, thereby alleviating the growing crisis sparked by a decade of fiscal mismanagement. Indeed, the situation was so dire that in November 2020, at the height of the COVID-19 pandemic, Suriname defaulted on its sovereign debt, and Paramaribo was forced to devalue the Surinamese dollar sharply. Those events intensified the economic catastrophe while forcing the government to restructure Suriname’s existing debt and seek additional international capital.

By February 2023, the financial crisis had become so dire that the IMF imposed austerity measures on the former Dutch colony. These, along with further devaluing the currency, were implemented by Santokhi’s administration in exchange for obtaining access to urgently needed loans. The harsh scheme was imposed on Paramaribo due to Suriname’s ballooning public debt, soaring inflation, and declining gross domestic product (GDP), which had plummeted by a whopping 51% over a decade to around $3.5 billion by 2023. Suriname’s economic catastrophe is rooted in the chronic malfeasance and corruption that prevailed during the 10-year tenure of President Santokhi’s predecessor, President Dési Bouterse, a convicted murderer linked to cocaine trafficking.

These arrangements, coupled with Paramaribo slashing spending, caused the cost of living to spiral higher in a country where nearly a fifth of the population lives in poverty. The fallout was severe, with unemployment, inflation, and poverty soaring due to the harsh economic austerity being implemented. This fomented considerable unrest among Suriname’s population, particularly as prices soared because of the sharp devaluation of the Suriname Dollar. These developments sparked mass anti-government protests with participants demanding the resignation of President Santokhi while riots broke out in the capital Paramaribo, with protestors storming Suriname’s parliament.

This intensified the government’s desire to kickstart the economy, especially after decades of financial neglect and witnessing the transformational riches generated by neighboring Guyana’s monumental oil boom. The considerable wealth created by the petroleum discovered in the Stabroek Block saw Guyana, last year, overtake Uruguay to become South America’s wealthiest country by GDP per capita. Indeed, Guyana’s 2024 GDP per capita soared by a stunning 41%, hitting a record $30,960, which is significantly higher than Uruguay’s $23,000 and more than four times greater than Suriname’s $7,600. Surprisingly, Guyana’s GDP per capita is also now higher than that of members of the European Union, including Portugal and Hungary.

The key issue weighing on Suriname’s much-needed oil boom is the considerable delay associated with developing offshore Block 58. TotalEnergies, the operator and 50% partner of APA Corporation, postponed development of the 1.4 million-acre block in 2022 due to concerns over reservoir quality and a high gas-to-oil ratio. This changed with the October 2024 approval of the GranMorgu project in Block 58’s southern zone, with TotalEnergies and APA announcing their $10.5 billion final investment decision (FID).

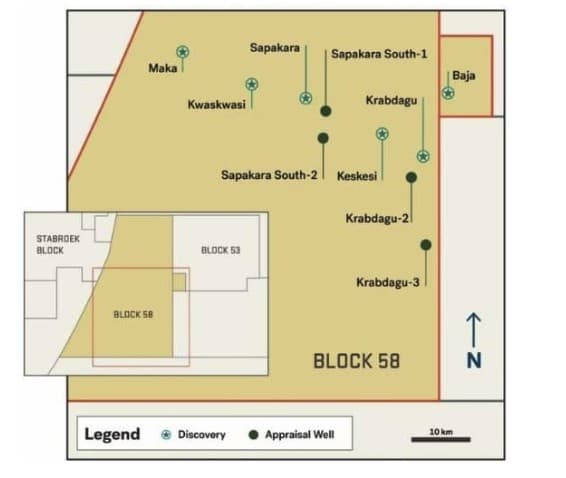

Source: TotalEnergies.

The GranMorgu facility, with a planned nameplate capacity of 220,000 barrels per day, is targeting a 760-million-barrel resource identified by the Sapakara and Krabdagu oil discoveries.

Staatsolie, Suriname’s national oil company and petroleum industry regulator, will execute its right to participate in the GranMorgu project, which the company believes will cost $12.2 billion to complete. In exchange for investing $2.4 billion, Staatsolie will receive a 20% interest, which will bolster the state-controlled company’s income. The funds were raised through a January 2025 bond issue, which secured $515.8 million, or $211.7 million more than the $304.1 million targeted. Paramaribo hopes this considerable investment in Suriname’s future will herald the beginning of an oil boom that will lift the tiny South American country out of poverty and generate revenue exceeding hundreds of millions of dollars.

Offshore Block 58 contains considerable petroleum potential, illustrated by the five major discoveries made on the acreage since 2020. The block is contiguous with the prolific Stabroek Block in Guyana’s territorial waters, where Exxon made an incredible 46 world-class discoveries and is now lifting over 600,000 barrels daily. There is considerable speculation that the petroleum fairway responsible for Exxon’s stunning success extends into offshore Suriname’s Block 58, and even beyond.

Source: APA Corporation Second-Quarter 2024 Financial and Operational Supplement.

This, along with appraisal drilling and seismic results, indicates further world-class discoveries will be made in the 1.4-million-acre offshore block once TotalEnergies recommences exploration drilling.

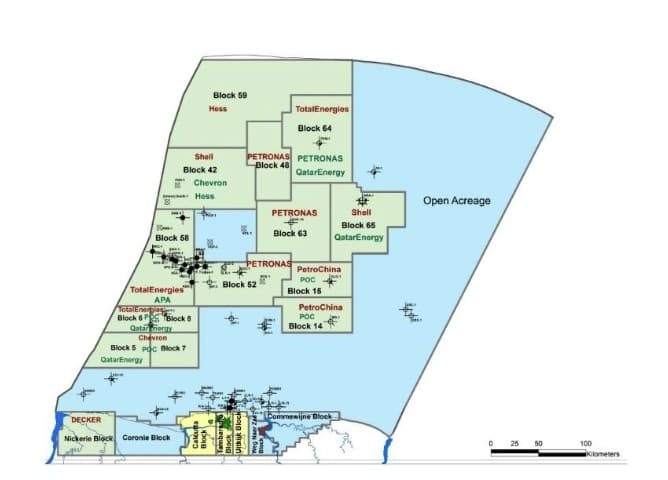

Suriname’s burgeoning oil boom is not limited to Block 58; a series of other discoveries made since drilling began in 2020 suggests that oil reserves and production will continue to grow over the next decade. Among the most significant are the three made by Malaysia’s national oil company, Petronas, in the 1.2 million-acre Block 52 offshore Suriname. This oil acreage is adjacent to Block 58, sparking speculation that it also contains the same petroleum fairway that commences in the Stabroek Block.

Source: Staatsolie.

The operator of Block 52 Petronas, with then-50 % partner Exxon, made the first discovery in December 2020 with the Sloanea wildcat well, followed by the Roystonea-1 discovery in November 2023. A third discovery was made with the Fusaea-1 exploration well during May 2024. Despite these drilling successes. not long after the last discovery, Exxon exited its Block 52 partnership with Petronas.

The global supermajor signed over its 50% share of the oil acreage to Malaysia’s national oil company in November 2024. Exxon exited Block 52 as part of its asset review process and focus on developing those operations the company believes offer the most commercial potential, making them highly profitable. As far back as 2020, at the height of the COVID-19 pandemic, Exxon announced it was prioritizing the development of the prolific Stabroek Block. That decision delivered Exxon the highest quality and most productive acreage in the Guyana-Suriname Basin, explaining why the supermajor exited less promising regional assets.

Block 52 is believed to possess significant hydrocarbon potential. Energy industry consultancy Rystad estimates the three discoveries contain resources exceeding 500 million barrels of oil equivalent. Another consultancy, Wood Mackenzie, in an April 2025 report, stated that those discoveries possess sufficient light oil to support a small cluster of 100,000 barrels per day of petroleum development. The firm believes the Sloanea discovery holds two trillion cubic feet of natural gas, giving it the potential to form the hub of a non-associated gas project. Wood Mackenzie anticipates that such a development could receive an FID by the end of 2027, with first gas occurring as early as 2031. The likelihood of such a development is supported by Petronas conducting appraisal work and having secured tax relief from Paramaribo for the buildout of a natural gas operation.

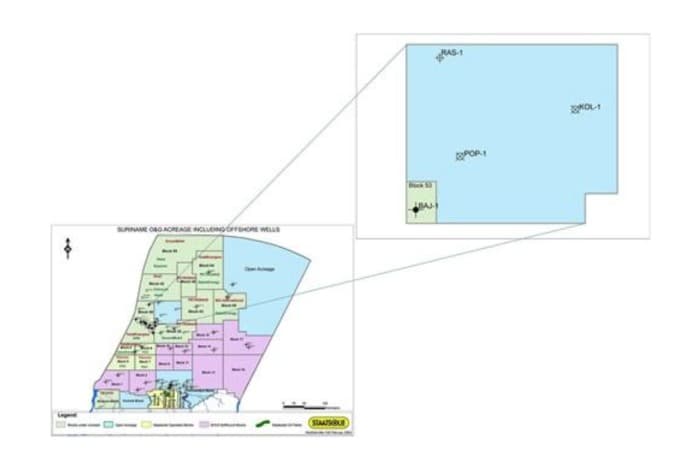

Nearby Block 53, which is contiguous with Block 58 and Block 52, is also believed to contain considerable hydrocarbons. It was here during August 2022 that the operator APA, which controls 45% of the block, discovered oil with the 17,356 feet or 5,290-meter-deep Baja-1 wildcat well. The driller’s preliminary analysis indicated it had found light oil with an impressive gas-to-oil ratio (GOR) of 1.6 to 2.2 million cubic feet (Mcf) of gas per barrel of oil contained in what the company considers a good-quality reservoir. The discovery is located on the same depositional system as the Block 58 Krabdagu discovery, seven miles (11.5 kilometers) to the west, which is being developed as part of the GranMorgu project.

While those characteristics point to the considerable petroleum potential held by the discovery, its commercial viability will not be determined until appraisal drilling is completed, although APA estimates Block 53 contains 100 million barrels. The driller also received regulatory approval to extend the Block 53 exploration period by four years, giving APA a greater opportunity to assess the Baja-1 discovery. Since the discovery, APA and its Block 53 partners, which are Petronas holding 30% and CEPSA with 25%, in February 2024 returned most of the oil acreage to Staatsolie. The syndicate chose to retain the immediate area surrounding the Baja-1 well, shown by the map below.

Source: Staatsolie.

This significantly reduced costs for the consortium by eliminating the obligatory drilling program that would have been required if the full acreage had been retained.

There is considerable potential for oil projects in Suriname, although it will take time before the FIDs are made and the billions of dollars required to construct the facilities are invested. Regardless of the hurdles, Suriname’s hydrocarbon output is expected to grow over the coming decade, particularly with the first oil from the 220,000 barrel-per-day GranMorgu development anticipated in 2028. Optimistically, some years ago, Paramaribo predicted Suriname will be pumping one million barrels per day by 2030, which is now an unrealistic target. However, the country could be lifting 650,000 barrels daily by 2032. While that number is significantly lower than Paramaribo’s earlier expectations, it will deliver a handy economic benefit, which if appropriately administere,d will lift Suriname out of poverty.

By Matthew Smith for Oilprice.com